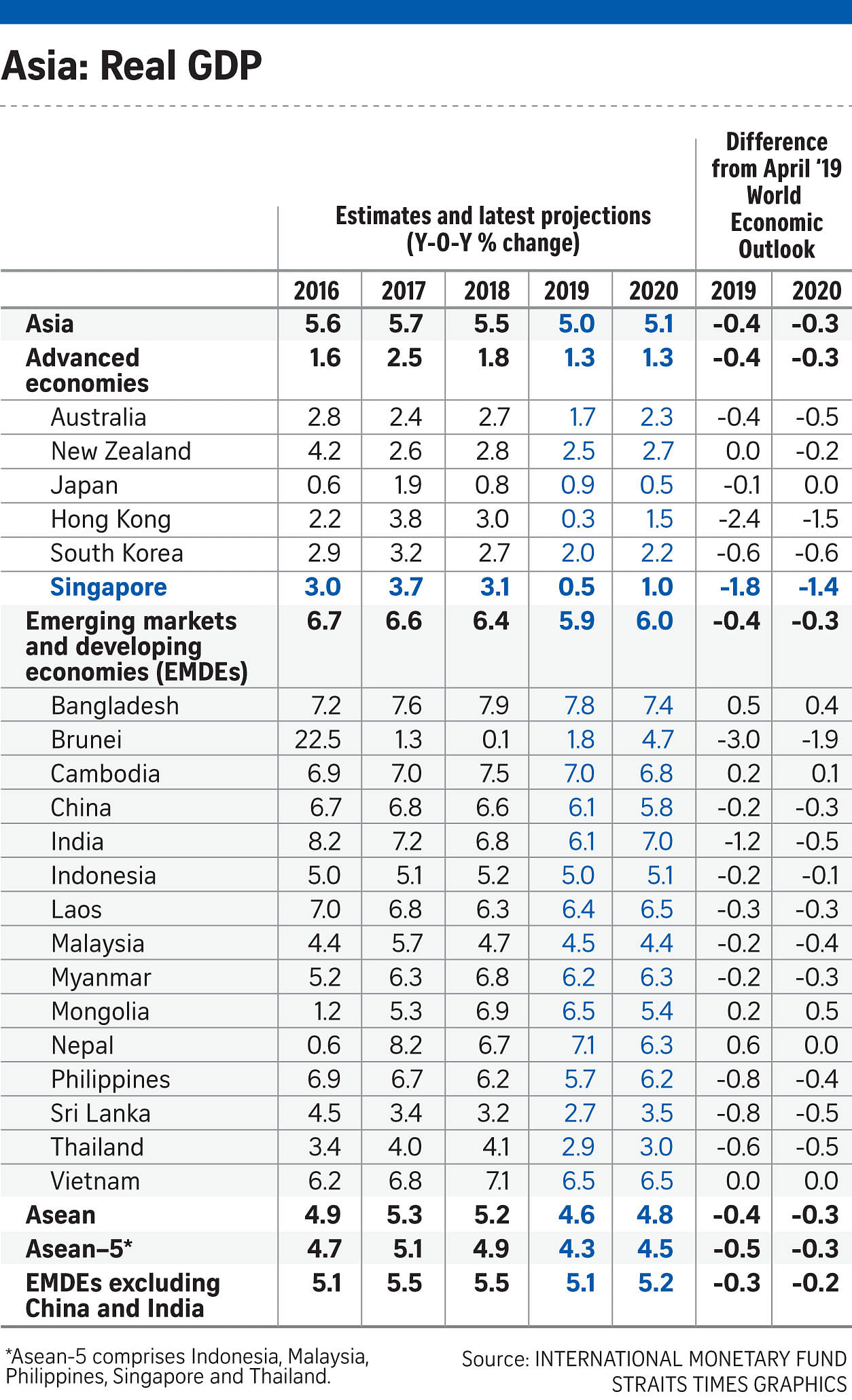

The International Monetary Fund (IMF) has slashed GDP growth forecasts for Singapore as well as most other Asian economies for this year and next year relative to its estimates in April.

In its latest Regional Economic Outlook released yesterday, IMF projects Singapore's growth for this year to be 0.5 per cent, sharply down from the 2.3 per cent it had forecast in its World Economic Outlook in April. The Singapore Government expects growth to come in between 0 per cent and 1 per cent this year.

Some private economists predict the number will be at the lower end of that range. Singapore's growth last year was 3.1 per cent.

For next year, the IMF estimates Singapore's growth at 1 per cent, compared with its prediction of 2.4 per cent in April.

The IMF forecasts that China's growth will fall to 6.1 per cent this year, and then further to 5.8 per cent next year, from 6.6 per cent last year. India is also projected to grow at 6.1 per cent this year, down from 6.8 per cent last year.

Among Asian economies, Hong Kong is expected to experience the sharpest slowdown, with gross domestic product growth slowing to 0.3 per cent this year, compared with 3 per cent last year. In its April projections, which were made before the political turmoil in the territory intensified, the IMF had forecast that Hong Kong would grow at 2.7 per cent.

Taken together, Asian economies will grow at 5 per cent this year, according to the IMF, their slowest expansion since the global financial crisis of 2008. However, Asia will remain the world's fastest-growing region, contributing more than two-thirds to global growth.

Asia's economies are faced with "a likely prolonged period of heightened global policy uncertainty", according to the IMF.

It noted that while the region's strong trade and financial inte-gration is a sign of its economic success, it can also be a source of vulnerability.

One major risk is a possible escalation of the United States-China trade dispute. The IMF's baseline forecasts assumed the continuation of all US tariffs imposed or announced before this month.

However, the US and China struck a mini-trade deal early this month under which the US agreed to hold off on increasing tariffs on US$250 billion (S$341 billion) worth of Chinese goods from 25 per cent to 30 per cent, scheduled to take effect on Oct 15. China also agreed to step up its purchases of US farm goods.

While acknowledging the possibility of such upside surprises, the IMF pointed out that the path to durable trade agreements "remains subject to protracted and difficult negotiations", adding that new setbacks could weigh on confidence, weakening trade, investment and growth.

For Asia, they could trigger shifts in supply chains out of China.

This process has begun, with more than 50 companies having announced plans to move production out of China to avoid the risk of tariffs, including major manufacturers such as Apple, Samsung, HP, Dell and Nintendo. Most are considering relocating operations to Southeast Asia and Mexico, in particular.

Among other risks, the IMF flagged the possibility of tighter financial conditions in Asia as a result of abrupt changes in investors' risk appetite, arising from either new trade restrictions or a reassessment of valuations.

Capital outflows, coupled with a rise of the US dollar and higher costs of dollar financing, could lead to slower growth in the region.

A faster-than-expected slowdown in China could add to the problem, given the close trade links between Asian economies and China, as well as the integration of these econo-mies in global value chains.

A more volatile Chinese currency could also lead to financial spill-overs, according to the IMF.

Other risks for Asian economies include higher oil prices arising from supply-side shocks such as the drone attack on a Saudi oil refinery last month; an escalation of the trade dispute between Japan and South Korea, which would affect technology supply chains; and sociopolitical risks in ter-ritories such as Hong Kong and Kashmir, which may have economic repercussions.

To cushion the economic slowdown, the IMF recommended that Asian economies pursue accommodative monetary policies, which most are already doing.

India should revive the flow of bank credit through a faster cleanup of bank and corporate balance sheets. The IMF also called for expansionary fiscal policies in countries which have fiscal space, such as China, South Korea and Thailand.

For the medium term, the IMF proposed that Asian countries should lay the groundwork for strong, sustainable and inclusive growth through further trade integration, including in services.

They should also reform their product markets - for example, through pro-competition policies - as well as labour markets, by upgrading skills, taking measures to increase labour supply in countries where there are shortages, improving access to education, and promoting the participation of women and the elderly in the workforce.

Such measures "would not only help offset the demand shock from slower global trade but also facilitate adjustment to realigning global supply chains", the IMF said.