SINGAPORE - The Covid-19 shock has affected Singapore's domestic-oriented industries more severely than in past recessions, so economic recovery will likely take longer, the Monetary Authority of Singapore (MAS) said on Wednesday (Oct 28).

MAS said the pace of recovery is expected to moderate in the quarters ahead, as firms and households continue to be restrained by income loss and increased uncertainty, in turn holding back on investment and discretionary spending.

Downside risks to the growth outlook could also materialise if a resurgence in worldwide Covid-19 infections prompts more shutdowns and results in weaker-than-expected external demand, or if domestic labour market conditions deteriorate further and hamper a decisive pickup in consumer demand.

MAS reiterated the Government's forecast for the economy to shrink by a record 5 per cent to 7 per cent this year because of the coronavirus pandemic. It said the economy will post above-trend growth for 2021 due to the effects of the low base in 2020.

"The path ahead remains clouded with uncertainty," MAS warned in its twice-yearly macroeconomic review released on Wednesday.

"Some pockets of the economy, particularly the travel-related and some contact-intensive domestic services, are not expected to recover to pre-pandemic levels even by the end of next year."

The Singapore economy registered its worst performance ever in the second quarter because of the circuit breaker measures, before experiencing a growth rebound in the July to September period when most of the movement curbs were relaxed.

The nation's gross domestic product (GDP) contracted in the second quarter by 13.2 per cent on a quarter-on-quarter seasonally adjusted basis. The rebound in the third quarter saw the economy expanding by 7.9 per cent on the same measure.

While some of the sectors, mainly export-driven manufacturing, have since seen a pickup as the economy reopened, overall output is still some 7 per cent below pre-Covid-19 levels, MAS noted.

The rebound in the third quarter was also aided by the Government's budgetary support measures. The impetus from fiscal support is likely to abate in the fourth quarter even as some measures such as the Jobs Support Scheme may persist.

DBS Bank's senior economist Irvin Seah said that while the Singapore economy is on the mend, amid the phased reopening at home and rebound in some regional markets, the recovery will remain uneven, and growth performance across sectors will differ considerably.

"The services sector has borne the brunt of the crisis and is expected to remain a drag on growth and employment," Mr Seah said.

MAS said that unlike the global financial crisis of 2008 when the resident unemployment rate returned to pre-crisis levels after six quarters, the recovery in employment is likely to be uneven and slow.

Indeed, the resident unemployment rate continued to rise to an average of 4.3 per cent in July to August even after phase two of the economy's reopening in June when the rate was at 3.8 per cent.

MAS said the unemployment rate among Singaporeans and permanent residents is likely to stay elevated in 2021, keeping wage growth low.

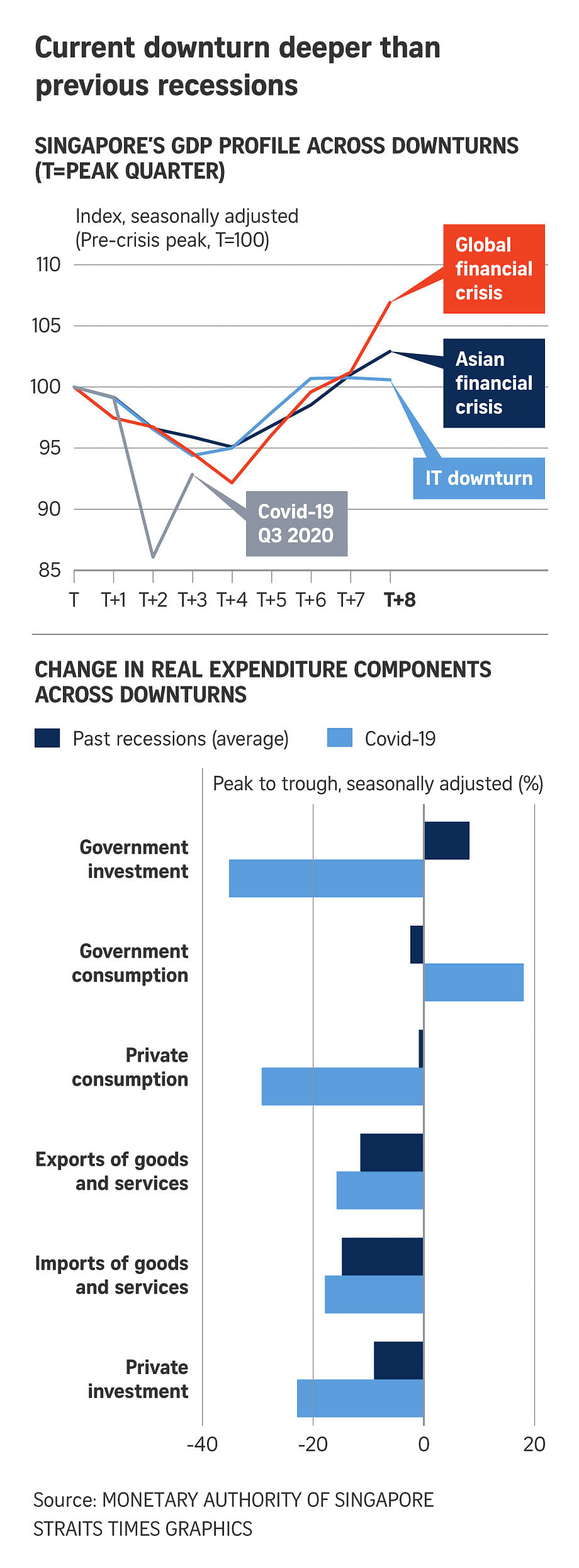

The central bank also said that the Covid-19 recession has been unprecedented in its intensity, having resulted in a cumulative 14 per cent decline in GDP from pre-crisis levels in the fourth quarter of 2019 to the trough in the second quarter of 2020. This compares with an average contraction of 6.1 per cent across the previous recessions.

Explaining why the recovery would take longer, MAS said the Covid-19 shock has disproportionately affected domestic-oriented and travel-related services in Singapore - such as food and beverage, retail, construction and aviation and hospitality - unlike previous recessions that were typically driven by the external-oriented manufacturing sector. These sectors have stronger interlinkages with firms and households within the domestic economy, thus amplifying the negative shock.

"Although the domestic-oriented sectors account for a smaller share of GDP compared to the external-oriented sectors, they generate significant indirect effects or negative spillovers on the economy through the production and consumption channels," MAS said.

The loss in final demand in the worst-hit sectors generates ripple effects through supply chains, affecting other firms in the same or different industries. The drop in final demand also prompts companies in the worst-hit sectors to make a proportional cut in wages for their employees, thus weakening household consumption.

Thus, MAS said: "In all likelihood, the recovery will be more protracted than those in the past."

For the global economy, the central bank expects the near-term rebound - supported by unprecedented fiscal and monetary policies - to fade into an incomplete recovery.

World economic growth is forecast to return to trend during 2022 as the recovery fades, but from a lower end-2021 level, leaving the global economy on a permanently lower GDP trajectory, it said.

Global GDP is projected to contract by 3.9 per cent in 2020. While the world economy will recover to grow by 6.2 per cent in 2021, it will still be about 4 per cent below the level projected before the Covid-19 shock.