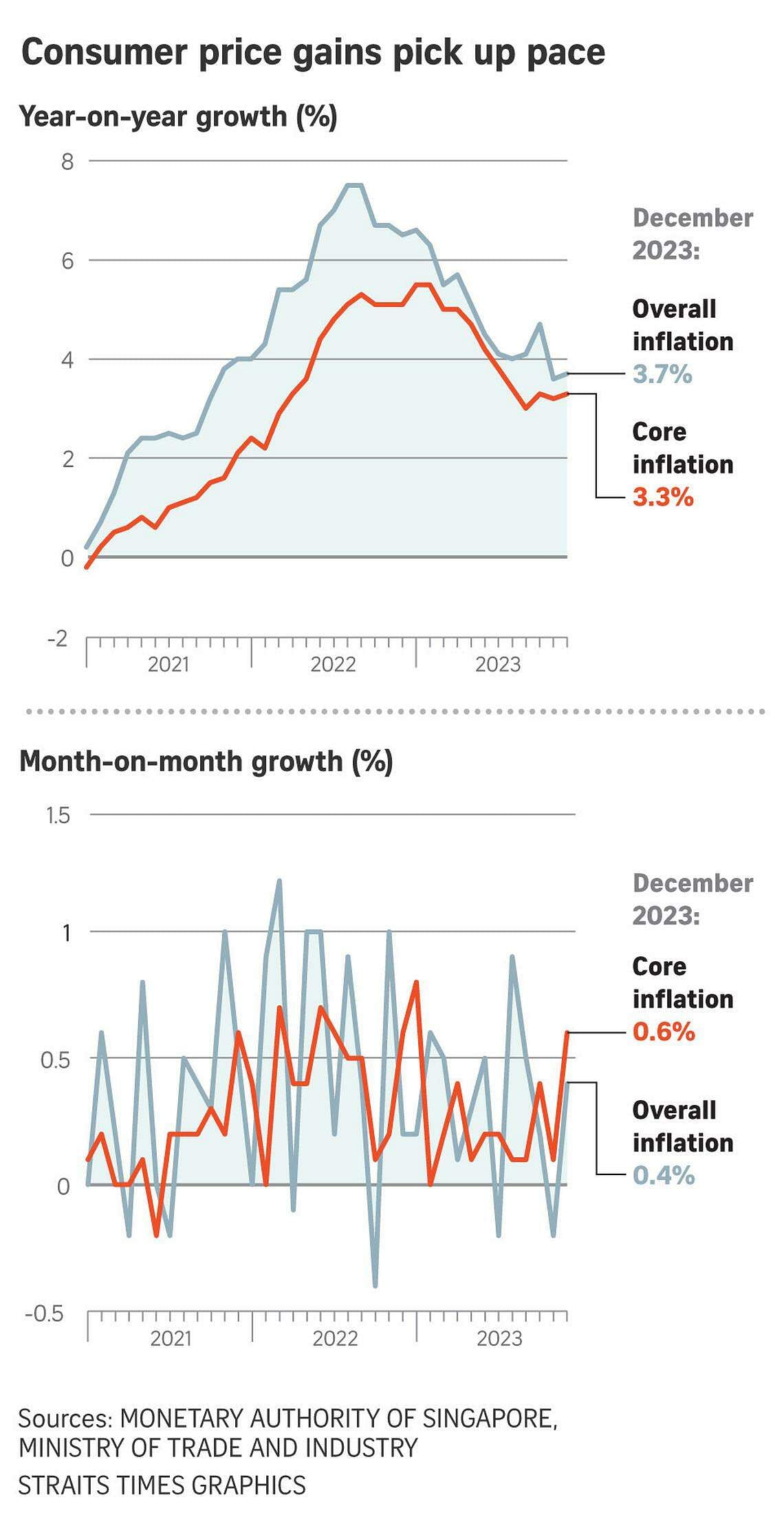

SINGAPORE – While overall inflation eased considerably in 2023, core consumer prices rose faster than expected in December, with price pressures expected to continue through early 2024.

For 2023, all-items, or overall, inflation averaged 4.8 per cent, down from 6.1 per cent in 2022, official data showed on Jan 23.

However, core inflation – which excludes private transport and accommodation costs to better reflect the expenses of local households – edged up in 2023 to 4.2 per cent from 4.1 per cent in 2022.

Inflation rates in 2023 were impacted by the increase in the goods and services tax (GST) rate to 8 per cent, the Monetary Authority of Singapore (MAS) and Ministry of Trade and Industry (MTI) said in a joint statement on Jan 23.

Both inflation measures came within sight of their 2023 forecasts of around 5 per cent for overall inflation and about 4 per cent for core inflation.

December’s core inflation accelerated to 3.3 per cent year on year, from 3.2 per cent in November and above the 3 per cent forecast by analysts in a Bloomberg poll.

Overall inflation also rose, to 3.7 per cent from 3.6 per cent in November.

Core inflation is expected to be affected in early 2024 by another hike in the GST rate to 9 per cent and other price increases, such as for bus and train fares – which took effect in late 2023 – and electricity and gas tariffs in the first quarter of 2024, said the joint statement.

However, core inflation should resume a gradual moderating trend over the rest of the year as import cost pressures decline and tightness in the domestic labour market eases, it said.

MAS and MTI also reiterated their core inflation forecast of 2.5 per cent to 3.5 per cent for 2024.

They noted, however, that certificate of entitlement (COE) premiums have been volatile, notwithstanding further increases in the COE quota since November 2023.

Hence, the forecast range for all-items inflation in 2024 will be updated in the next monetary policy statement due on Jan 29.

MAS and MTI also stressed that while inflation eased globally in 2023, upside risks remain.

The risks include fresh shocks to global energy and shipping costs due to geopolitical conflicts, higher food commodity prices from adverse weather events, and more persistent-than-expected tightness in the domestic labour market.

At the same time, an unexpected weakening in the global economy could induce a faster easing of cost and price pressures, MAS and MTI added.

Analysts generally agreed with the official stance on the outlook for inflation.

DBS Bank economist Chua Han Teng said he expects domestic drivers to keep core inflation up through early 2024.

Beyond the GST hike to 9 per cent on Jan 1 and the increase in utility prices in the first quarter, carbon taxes are also set to rise in 2024, while water tariffs will be raised in April, he said.

“Sticky inflation dynamics in the near term, as well as upside risks from geopolitical uncertainties and weather disturbances, are likely to see MAS remaining vigilant on inflation,” Mr Chua said.

For December, overall inflation was powered by services costs, including a 6.3 per cent surge in recreation expenses and a 5.1 per cent jump in healthcare costs, followed by a 3.9 per cent rise for both transport and communication.

Housing and utility costs rose 3.8 per cent, while food prices went up by 3.7 per cent.

Dr Chua Hak Bin, regional co-head of macro research at Maybank, said he expects MAS to maintain the current Singapore dollar appreciation stance in its upcoming quarterly review on Jan 29, given the elevated core inflation.

He said the disruption of shipping in the Red Sea, which has increased shipping costs, may also show up in January’s inflation data.

Drewry’s World Container Index, which tracks freight costs of a 40-foot container via eight major shipping routes, surged 2.3 times from the week of Dec 21 to the week of Jan 18, Dr Chua noted.

Mr Euben Paracuelles, an economist at Japanese investment bank Nomura, agreed that despite the stronger-than-expected December core inflation, MAS will likely leave its policy settings unchanged on Jan 29.

He added that stubborn inflation may delay an easing of MAS monetary policy that was expected in the latter part of 2024.