SINGAPORE – Central Provident Fund (CPF) members who wish to save more for retirement will be able to do so with a higher retirement sum ceiling from 2025.

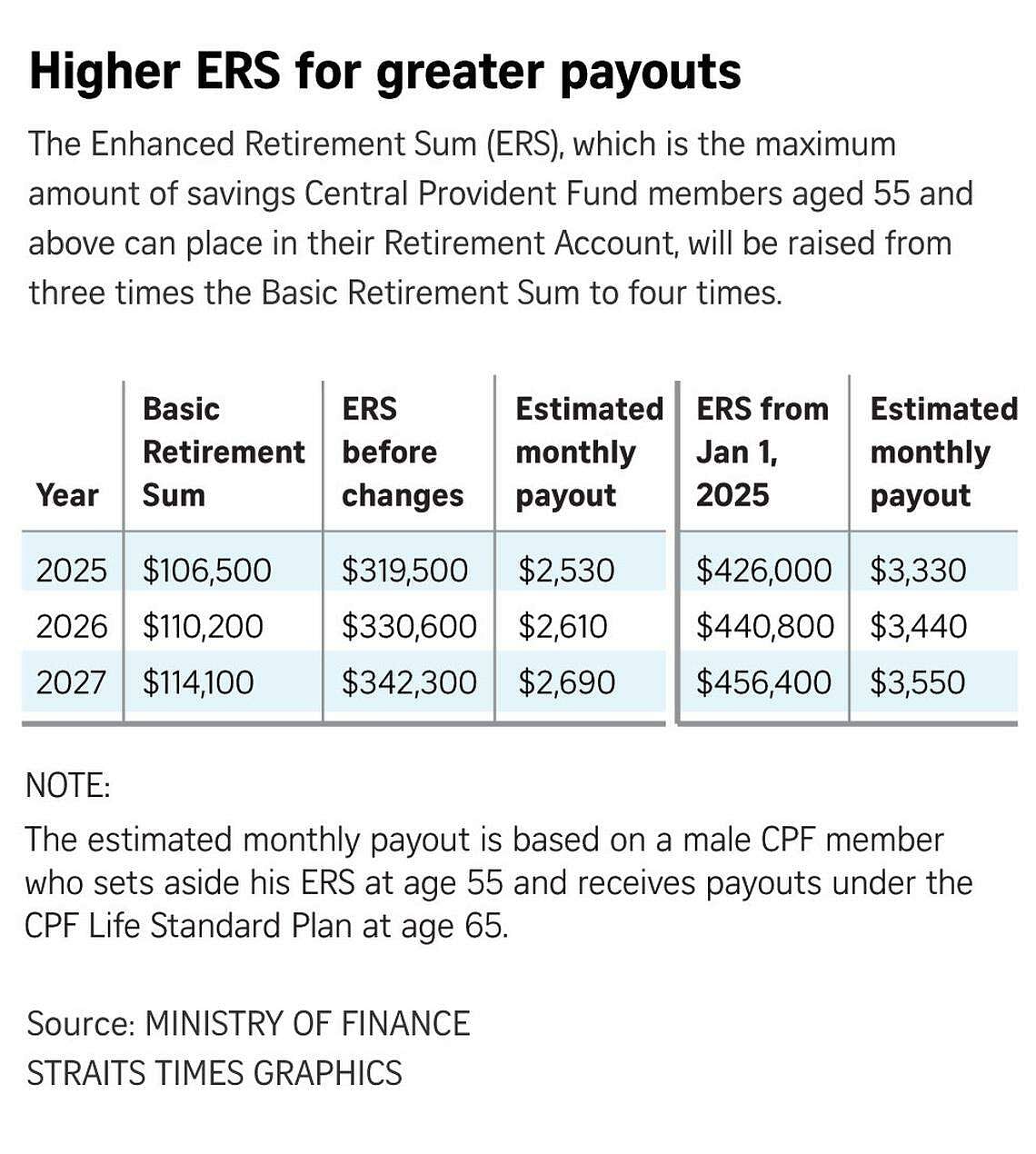

The Enhanced Retirement Sum (ERS), which is the maximum amount members can put in their CPF Retirement Account to accrue interest and receive payouts, will be pegged to four times the Basic Retirement Sum (BRS) from Jan 1, 2025.

This is up from three times now, Deputy Prime Minister Lawrence Wong said in his Budget 2024 speech in Parliament on Feb 16.

The ERS will hence be $426,000 in 2025, instead of $319,500, which DPM Wong said will allow more members aged 55 and above to commit their accumulated CPF savings to receive higher monthly payouts.

The BRS provides CPF members with monthly payouts to cover their basic living expenses during retirement.

The higher ERS is part of wide-ranging changes to the CPF system that DPM Wong, who is also Finance Minister, announced on Feb 16.

Also kicking in on Jan 1, 2025, is more retirement support for seniors under the Matched Retirement Savings Scheme (MRSS) and the Silver Support Scheme.

Under the MRSS, the Government now matches the amount of voluntary CPF top-up for Singaporeans aged 55 to 70 if they do not meet their BRS.

“I will extend the MRSS to those above the age of 70. This will enable more Singaporeans to meet their retirement needs, with help from their families, employers and the community,” DPM Wong said.

The cap on the amount matched will be increased to $2,000 annually, from $600 now, but the amount granted to an eligible member will be capped at $20,000 throughout his lifetime.

Moreover, cash top-ups that attract the matching grant will not qualify for tax relief with the changes, as the matching grant “is already a significant benefit extended by the Government”, added DPM Wong.

Currently, Singaporeans aged 55 and above receive tax relief on cash top-ups of up to $8,000 they make to their Retirement Account (RA).

The number of CPF members eligible for the MRSS is expected to more than double, from 395,000 in 2024 to about 800,000 in 2025.

Meanwhile, the per capita household income threshold to qualify for the Silver Support Scheme will be raised from $1,800 to $2,300.

The threshold to qualify for increased support under the tiered scheme, which targets seniors who earn low incomes during their working years and have less family support, will also be raised from $1,300 to $1,500.

Quarterly payments made under the scheme will be increased by 20 per cent across all tiers as well to keep pace with inflation, DPM Wong said.

The enhanced Silver Support Scheme will benefit around 290,000 Singaporeans aged 65 and above, the Ministry of Finance (MOF) said in a statement on Feb 16.

To streamline the CPF system, the Special Account (SA) of members aged 55 and above will be closed starting from early 2025, DPM Wong announced.

This means that all CPF members will have three CPF accounts at any one time, with the RA or SA as the sole account holding savings intended for retirement payouts, depending on the member’s age. The other two accounts are the Ordinary Account (OA) and MediSave Account (MA).

SA savings will be transferred to the RA up to the Full Retirement Sum, and continue to attract the same long-term interest rate.

DPM Wong said the remaining SA savings will be transferred to the OA, but members can voluntarily transfer their OA savings to the RA at any time to earn higher interest and receive higher retirement payouts.

Otherwise, members may choose to keep those savings in the OA, where they remain withdrawable and will earn the short-term interest rate.

The long-term interest rate, which applies to the SA, RA and MA, is currently set at a minimum of 4 per cent, while the short-term interest rate applying to the OA is currently held at a 2.5 per cent minimum.

“As a principle, only savings that cannot be withdrawn on demand should earn the long-term interest rate, and savings that can be withdrawn on demand should earn the short-term interest rate,” MOF said in its statement.

Senior workers aged above 55, and up to 65, will also see CPF contribution rates for their own contributions and those from their employers increase by a total of 1.5 percentage points from Jan 1, 2025.

This is the latest instalment of increases in contribution rates in steps through to about 2030, as recommended by the Tripartite Workgroup on Older Workers in 2019.

DPM Wong also said the CPF Transition Offset for employers will be provided for another year, to cover half of the increase in employer contributions for 2025.

“This will help to cushion the impact on business costs,” he added.