SINGAPORE – Cryptocurrencies that are issued privately have failed the test of digital money, Mr Ravi Menon, managing director of the Monetary Authority of Singapore (MAS), said on Thursday.

They have performed poorly as a medium of exchange or store of value, he noted.

The prices of cryptocurrencies are volatile and many investors have suffered heavy losses, he added.

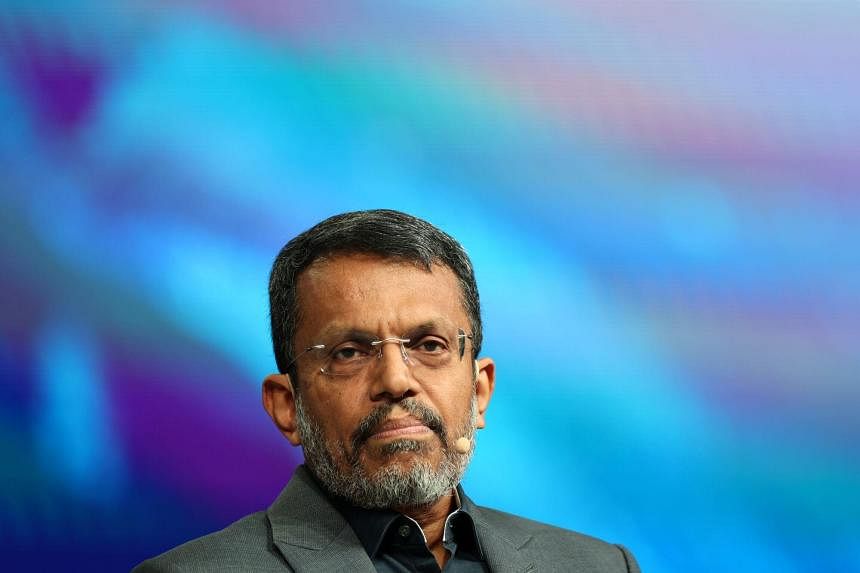

Mr Menon made the point in a speech at the Singapore Fintech Festival conference at the Singapore Expo on Thursday, when he outlined the four contenders for digital money.

They are cryptocurrencies, central bank digital currencies (CBDCs) or wholesale CBDCs, tokenised bank liabilities and stablecoins that are well regulated.

Tokenisation involves converting financial instruments or obligations issued by a bank into digital tokens and which can be transferred or recorded on a digital ledger, or blockchain. Examples of bank liabilities are loans and deposits.

The MAS chief, who is retiring on Jan 1, said wholesale CBDCs and tokenised bank liabilities can play the role of digital money and help to achieve atomic settlement, which allows simultaneous and irreversible transfers of assets or funds between parties.

He noted that MAS has conducted many experiments on the use of wholesale CBDCs with other central banks and the financial industry.

The regulator will now further expand testing to the live issuance of wholesale CBDCs to instantaneously settle payments across commercial banks.

MAS will soon partner the local banks to pilot the use of wholesale CBDCs as a common settlement asset in domestic payments.

“Banks will issue tokenised bank liabilities that represent claims on their balance sheets by their retail customers. Retail customers will be able to use these tokenised bank liabilities in transactions with merchants, who can then credit these tokenised bank liabilities with their respective banks,” Mr Menon said.

Outstanding interbank obligations arising from these transactions will be settled via an automatic transfer of wholesale CBDCs.

What this means is that clearing and settlement will be done in a single step, on the same infrastructure. This is unlike the existing process where clearing and settlement take place on different systems, and settlement occurs with a lag.

On stablecoins, Mr Menon said that if well regulated, they can potentially play a useful role as digital money alongside CBDCs and tokenised bank liabilities.

Stablecoins are cryptocurrencies whose value is pegged, or tied, to that of another currency.

In Singapore, MAS has come up with a regulatory framework for stablecoins and the legislative amendments “will not be ready for at least a year”, he said.

In the interim, the regulator recognises entities whose stablecoins can already demonstrate compliance with the new regulatory framework.

MAS has granted in-principle approval (IPA) under the Payment Services Act to StraitsX and Paxos Digital Singapore, which will issue stablecoins that mostly comply with the new framework.

Paxos will issue stablecoins pegged to the United States dollar on a one-to-one basis.

StraitsX, payment infrastructure for digital assets, said the IPA enables it to issue stablecoins XSGD and XUSD – matched one-to-one with the Singdollar and US dollar respectively.

“XSGD is currently issued out of Xfers and is available for minting and redemption via the StraitsX platform. XUSD will be released publicly in the near future, in compliance with MAS’ upcoming single-currency stablecoin regulatory framework requirements,” StraitsX said.